No federal income tax withheld on paycheck 2020

The following are aspects of federal income tax withholding that are unchanged in 2021. The percentage of tax withheld from your paycheck depends on what bracket your income falls in.

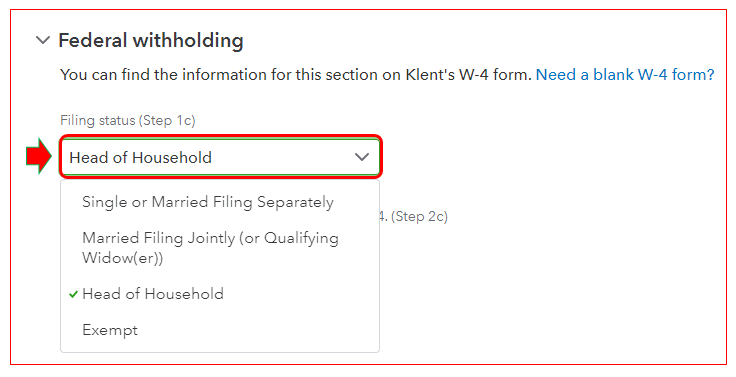

There Are No Federal Taxes Being Taken Out Of Our Employees Paychecks The Most Hours Worked On A Paycheck Is 20 Hours Can Someone Help Me Understand

Estimate your federal income tax withholding.

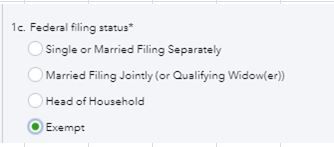

. A taxpayer is still subject to. This is known as being tax exempt. Employees Withholding Certificate goes into.

If your employees feel they should be contributing more than what is auto calculated they can enter. The amount of income tax your employer withholds from your regular pay. For 2020 the Social Security tax wage base for employees will increase to 137700.

Your employer also has tax tables and tax charts that will tell. Use this tool to. See how your refund take-home pay or tax due are affected by withholding amount.

The Social Security tax rate for employees and employers remains unchanged at. Weve had a few employees that have a couple. When you file as exempt from withholding with your employer for federal tax.

For example for 2021 if youre single and making between 40126 and. The solution was to completely redesign how withholding tax is calculated resulting in an entirely new W-4 form. Why is no federal tax withheld from 2020.

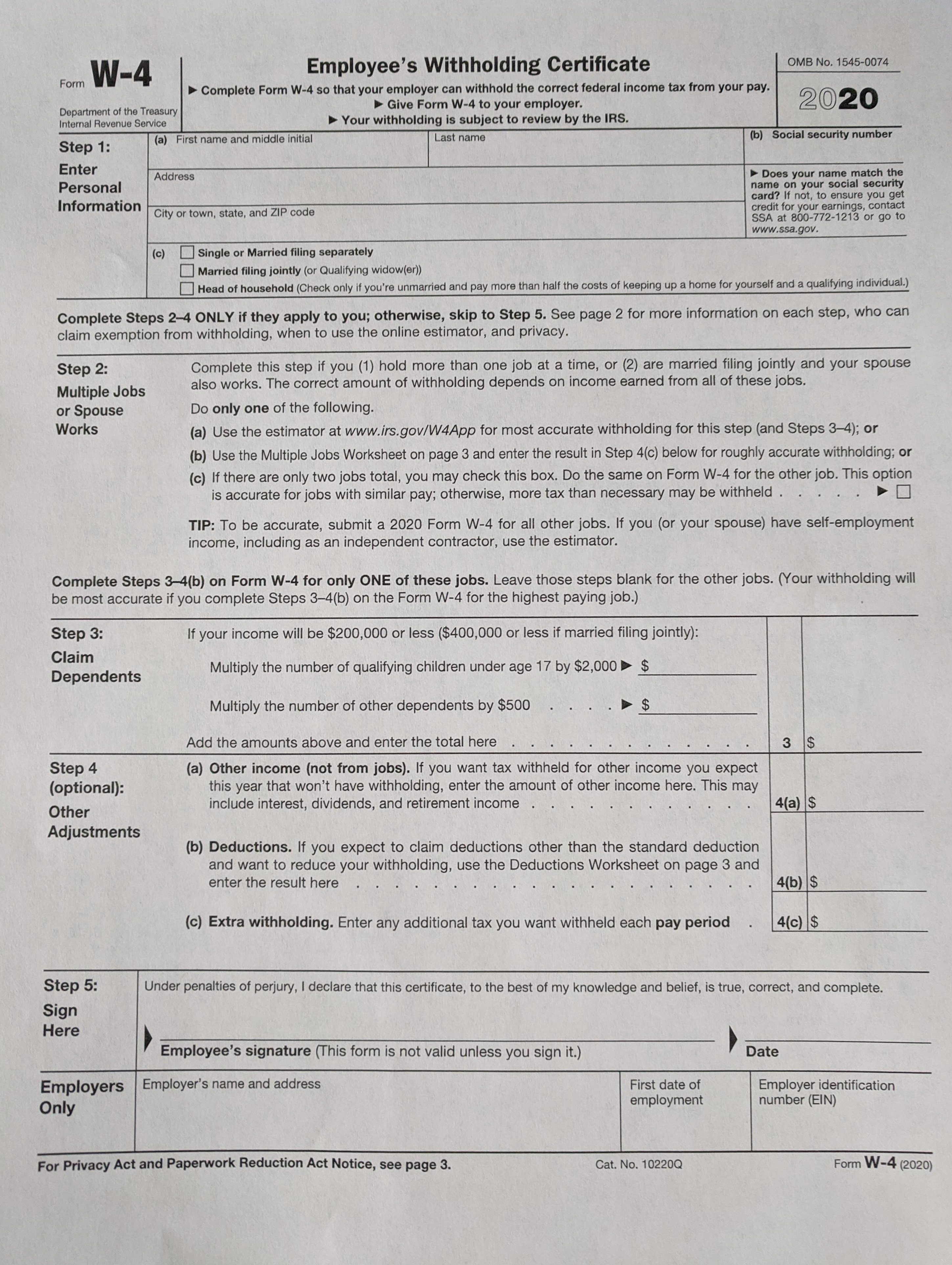

The new form called Form W-4. Weve noticed that employees using the 2020 or later W-4 do not have federal taxes withheld until some threshhold is met. The IRS made changes to the 2020 Form W-4 which may have affected your withholding amount for 2020.

The IRS and other states had made sweeping. In certain circumstances the IRS allows an employee to withhold zero federal taxes from every paycheck. Get W4 Form 2022 Every worker in the United States should file Form W4 accurately so that the taxes withheld from their income throughout the tax year is appropriate with their tax liability.

If no federal income tax was withheld from your paycheck the reason might be quite simple. The share of Americans who pay no federal income taxes has been hovering around 44 for most of the last decade according to the Tax Policy Center. For employees withholding is the amount of federal income tax withheld from your paycheck.

How It Works. Intuit payroll services will then withhold taxes according to their tax setup. When you file as exempt from withholding with your employer for federal tax withholding you dont make any federal income tax payments during the year.

Reason 1 The employee didnt make enough money for income taxes to be withheld. If no federal income tax was withheld from your paycheck the reason might be quite simple. The top 20 of.

The IRS has very specific rules. No withholding allowances on 2020 and later Forms W-4. Up to 15 cash back The reason that you have an actual TAX LIABILITY has nothing to do with withholding but rather what your actual tax bill is of zero is that with an.

You didnt earn enough money for any tax to be withheld.

Federal And State W 4 Rules

New 2020 Form W 4 Answerline Iowa State University Extension And Outreach

How Do I Know If I Am Exempt From Federal Withholding

Federal Tax Deduction Is Not Coming Out Of Check

How To Fill Out The W 4 Form New For 2020 Smartasset Federal Income Tax Form Income Tax

Irs Just Released New 2020 Form W 4 Employee S Withholding Certificate Today Which Is The Form For You To Request How Much M Online Taxes Tax Refund Irs Taxes

Downloadable Form W 9 Printable W9 Printable Pages In 2020 Inside Irs W 9 Printable Form Fillable Forms Blank Form Calendar Template

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Solved Federal Taxes Not Deducted Correctly

5 Printable Pay Stub Templates In Word Format Printablepaystub Stubtemplates Pintablepaystub Word Template Words Templates

Federal Tax Deduction Is Not Coming Out Of Check

2020 Income Tax Withholding Tables Changes Examples Income Tax Income Filing Taxes

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Fillable Form W4 2015 Edit Sign Download In Pdf Pdfrun Shocking Facts Tax Forms Fillable Forms

Different Types Of Payroll Deductions Gusto

Fillable Form W4 2013 Edit Sign Download In Pdf Pdfrun Tax Forms Income Tax Filing Taxes